The Biggest Companies that You've Never Heard Of

First published: Monday December 11th, 2023

Report this blog

The Ones You've Heard Of

If someone asked you what the biggest, richest company is, what would you say? Chances are, you'd probably say Amazon, Apple, Google, Microsoft, or something along those lines. So which one is technically the richest? On most lists, Apple usually comes out on top for being worth the most. Currently Apple's networth is over 3 trillion (More than the GDP of France). But is that the straight up answer? Not really.

Companies from the Past

While companies today are bound by limitations such as human rights and the inability to form monopolies, companies in the past didn't have this problem. Some of the richest companies from the past were the:

- The Dutch East India Company

- The British East India Company

- Standard Oil (Rockefeller's Company)

- The Mississippi Company

- The South Sea Company

Most of you have probably heard of the British and Dutch East India companies as well as Standard Oil, but I decided to include them as well.

The South Sea company was almost like a pre-modern Ponzi Scheme. Pretty much, they were selling more stocks than they actually had. They dealt in massive amounts of bribery, and took advantage of the British national debt. In the end, they accumulated about 4 trillion, before collapsing and completely ruining thousands of people who had invested.

The Mississippi Company was created by John Law, and worked closely with the French Government. It used sold shares in the company for paper money, he generated enough money to dominate the French trade. It created whats known as a economic bubble. Pretty much when a company generates massive amounts of money but then loses almost all of it soon after. At it's height, it was worth 6.5 trillion dollars. For comparison, Japan and Germany's annual GDP's aren't even 5 trillion.

Standard Oil - John D. Rockefeller took control over the United State's oil trade and formed a monopoly over it. At it's height, it was worth over 1 trillion dollars.

The British East India Company - This behemoth of a company controlled all of India at its height. It formed a monopoly over trade, and at it's height, it had twice as many soldiers as the actual British Army. Eventually it was disbanded and the British Government took control.

The Dutch East India Company - Often overshadowed by the British East India Company, the Dutch East India Company managed to accumulate 7.6 trillion dollars in today's money at its height. It's monopoly over Indonesia and other areas allowed it to grow massively.

Modern Companies Most People Don't Know

These are modern day companies that just aren't as well known as other companies.

Saudi Aramco - Originally a American Oil Company, the Saudi Arabian government took control of it in 1988. Currently, Saudi Aramco's market cap is valued at 2.145 trillion US dollars. Ranking it above both Amazon and Alphabet Inc. (Google). 3rd overall.

Nvidia - Nvidia's market cap is currently 1.156 trillion US dollars, ranking above companies like Tesla and Walmart, but still far below companies like Google and Microsoft. Centered in the USA, they specialize in technology.

The Hidden Giants?

While you are probably thinking that Apple, and the Dutch East India Company were rich (if you actually read the article and didn't just skip all the way down to the bottom) but these companies will blow them out of the water.

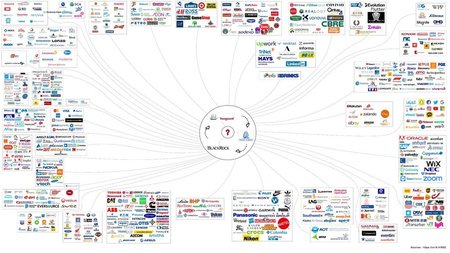

Blackrock and Vanguard Inc. both control trillions of dollars in assets. While technically these assets are controlled by the corporations and people that invest in them, both can heavily influence the global markets.

Blackrock currently manages about 9.4 trillion dollars worth of assets. They currently are massive shareholders in Disney, Amazon, Google, and many other major companies.

Vanguard currently manages about 7.7 trillion dollars worth of assets. They are massive shareholders in many major companies similar to Blackrock, and they own large shares of Disney, Amazon, Google, and too many others too list.

Pretty straightforward, right? You think you've gotten the gist of the article? It gets a lot more complicated than that though. State Street Inc. is the 4th largest controller of assets after Blackrock, Vanguard, and Fidelity. Vanguard owns 11.94% of State Street, and Blackrock owns 5.24%. Additionally, Vanguard owns about 10.58% of the multi-international conglomerate company Berkshire Hathway and Blackrock owns about 5.81% of it. To add a even bigger twist to this whole confusing situation, Vanguard actually owns 8.23% of Blackrock and Blackrock owns 13.32% of Vanguard.

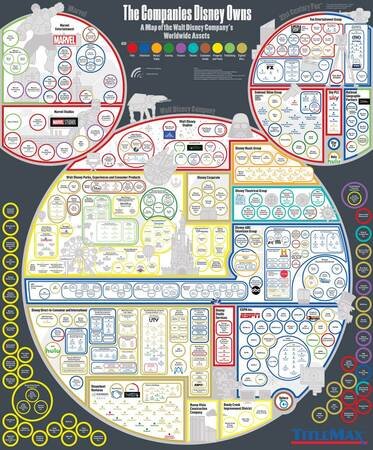

Its even more confusing when you consider that they own shares of companies that own dozens of other companies. Disney for example owns Marvel, Lucasfilm, Disney World, Disney+, Pixar, etc.

So lets take Avengers Endgame for this example. It generated about 2.798 billion dollars. It was produced by the Marvel franchise, which was bought out by Disney. Still simple. State Street invested in Disney, and Blackrock invested in State Street. Charles Schwab Investment Management invested in Blackrock, which by extension invested in State Street and Disney. But lets not forget that Vanguard has invested in all of these companies, by the chain of investments and independently. And most importantly, State Street, Vanguard, and Blackrock all invested in each other.

I could have made this chain much longer and more complex, but I think you all get what I'm trying to show.

Final Words

So what's the big takeaway from all of this? That big conglomerates (investment companies) rule the world behind the scenes, secretly manipulating the entire human race? Probably (JK).

Companies A and B are worth $100 each. Company C, an investment firm, buys $25 worth of stock in each company -- now Companies A and B are still worth $100 each, albeit partly owned by C, but Company C can also go value its holdings at $50 and someone can invest in them against that money.

$250 worth of stock available on the market for $200 worth of actual economic productivity.

I must be wrong about this somewhere, someone more versed in economics please tell me why this scenario wouldn't work (I have to believe it wouldn't!)